Percentage of tax taken from paycheck

Arizona income tax rate. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Also Know how much in taxes is taken out of my paycheck.

. For example if your gross pay is 4000 and your. Both employee and employer shares in paying these taxes. As you likely know a percentage of your gross pay each pay period is withheld to cover federal income taxes FICA contributions that is Social Security and Medicare taxes.

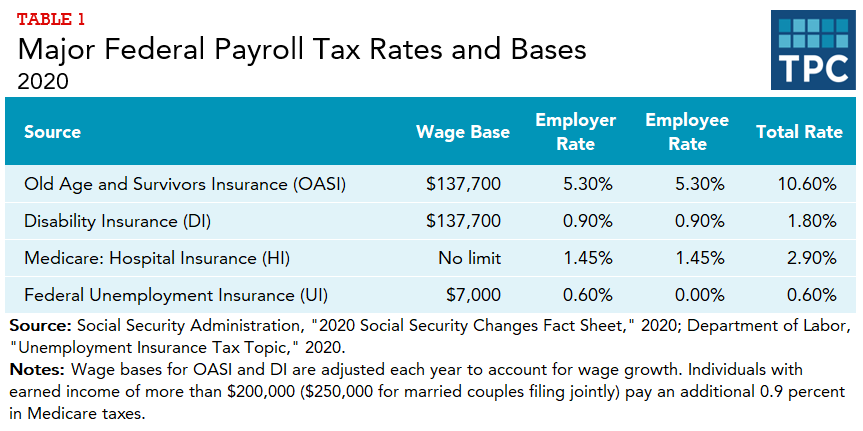

Youll need to make sure anyone you claim as a dependent qualifies. Also What is the percentage of federal taxes taken out of a paycheck 2021. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

Social Security tax. For example if your gross pay is 4000 and your total tax. These are contributions that you make before any taxes are withheld from your paycheck.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Census Bureau Number of cities that have local income taxes. The employer portion is 15 percent and the employee share is six percent.

Tennessee residents pay the highest overall sales tax nationwide with rates ranging from 850 to 975 depending on where you live. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is 5499.

Add up all your tax payments and divide this amount by your gross total pay to determine the percentage of tax you pay. The Social Security tax is 62 percent of your total pay until you reach an annual. According to the Ontario tax rates for 2021 the amount earned up to 45142 is taxed at a rate of 5.

This doesnt affect your paycheck but your wallet will. You can claim dependents based on a variety of factors such as a childs age their relationship to you if you. Every pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. FICA taxes are commonly called the payroll tax. Your employer will match that by.

You owe tax at a progressive rate depending on. There is a wage base limit on this tax. These taxes are deducted from your paycheck in fixed percentages.

Current FICA tax rates. Tax withholding based on your tax bracket Withholding from your paycheck is done on what is known as the graduated system. 4 rows What is the percentage that is taken out of a paycheck.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. This is divided up so that both employer and employee pay 62 each. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W.

FICA taxes consist of Social Security and Medicare taxes. For the 2019 tax year the maximum income. How do I calculate taxes from paycheck.

Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings. An amount over 45142 is taxed at 9142 up to 90287. You will owe the rest of the tax which is 153 percent.

Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay. However they dont include all taxes related to payroll. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

Arizona Paycheck Quick Facts.

Paycheck Calculator Online For Per Pay Period Create W 4

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How To Calculate Federal Income Tax

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

2022 Federal State Payroll Tax Rates For Employers

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Free Online Paycheck Calculator Calculate Take Home Pay 2022

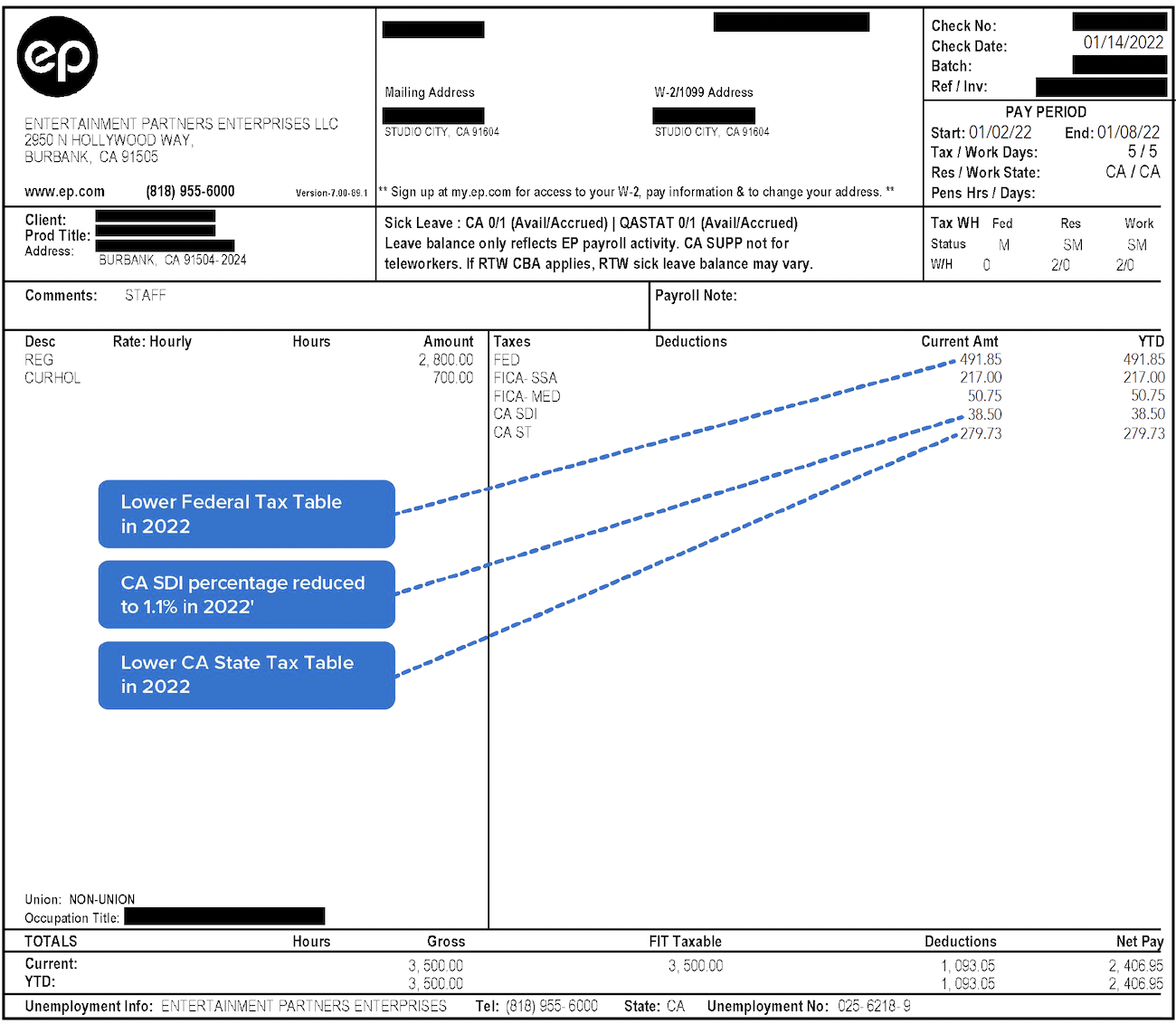

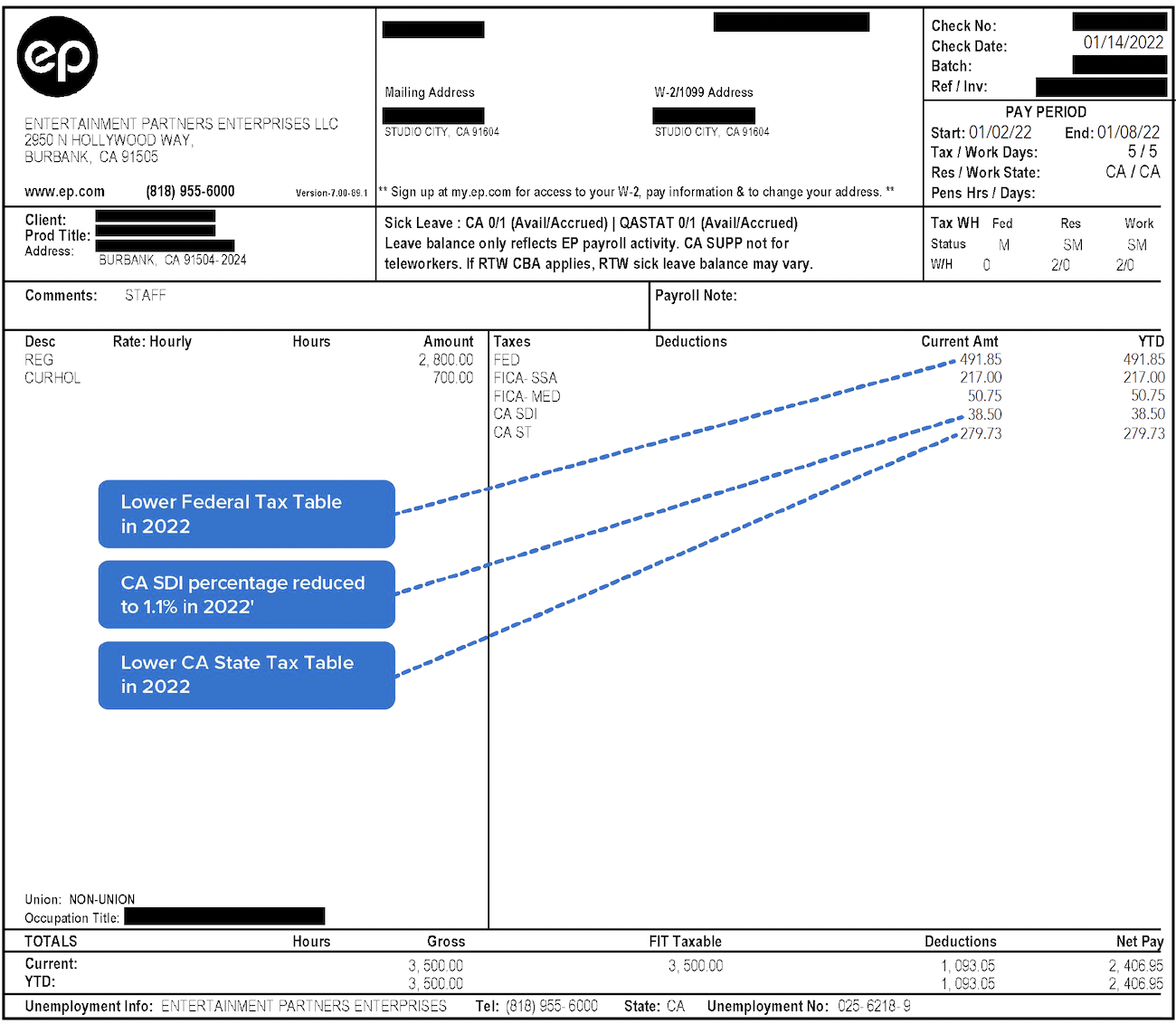

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Decoding Your Paystub In 2022 Entertainment Partners

Understanding Your Paycheck

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Irs New Tax Withholding Tables

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Payroll Tax What It Is How To Calculate It Bench Accounting