Biweekly plus extra payment mortgage calculator

By always having the same amount going toward your mortgage. Check out the webs best free mortgage calculator to save money on your home loan today.

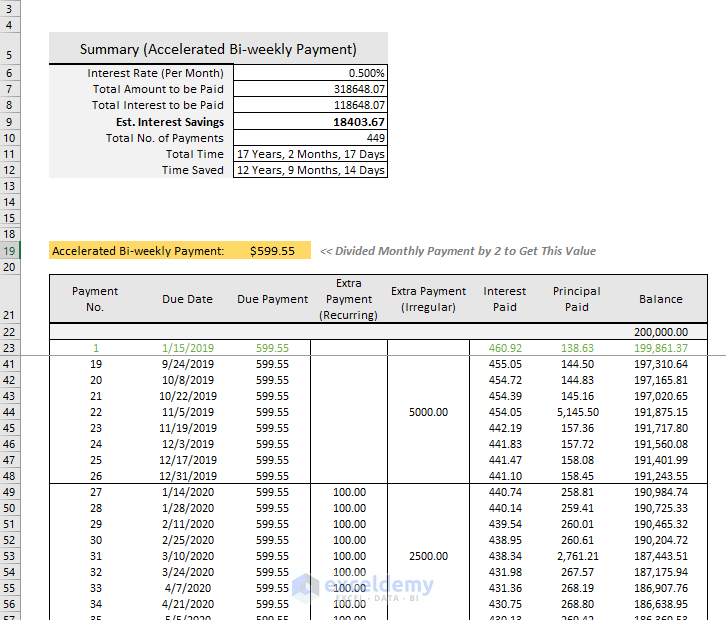

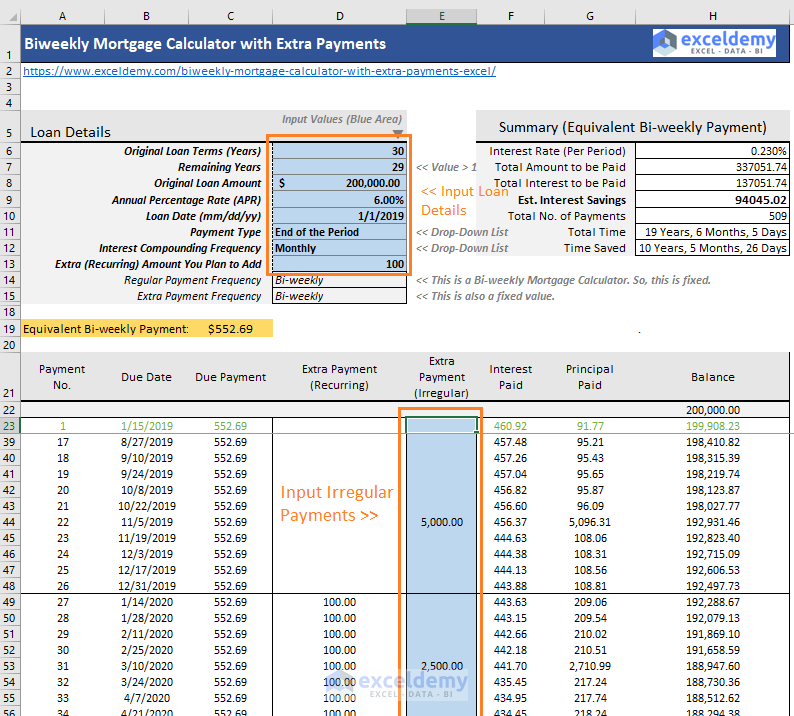

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Years to pay off.

. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. If you increase your payments you could pay down the principal faster. The 52-week high for a 30-year fixed mortgage was 6.

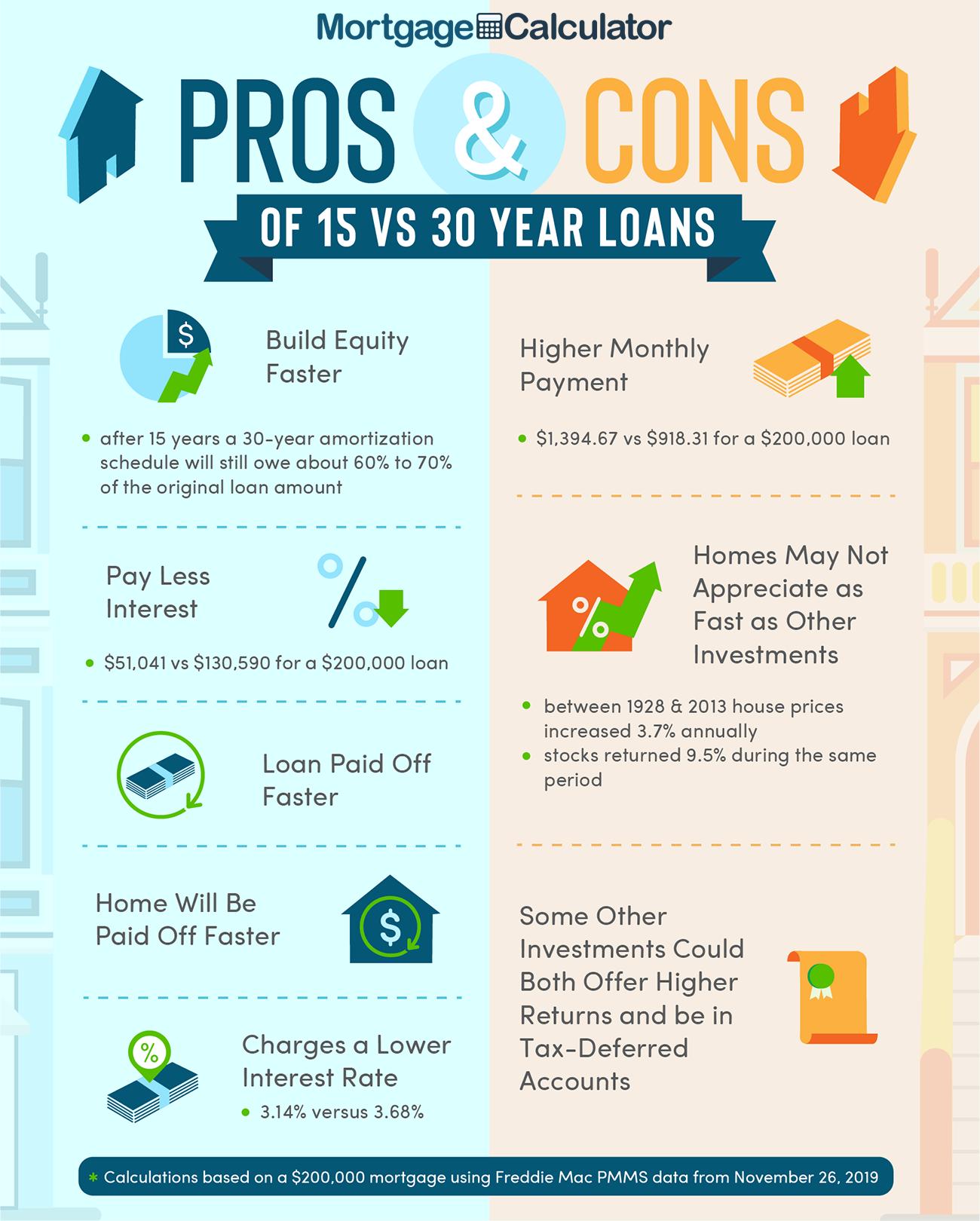

Mortgage Amount or current balance. For today Saturday September 03 2022 the national average 15-year fixed refinance APR is 5250 up compared to last weeks of 5140. Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal.

My goal was to use the Loan Calculator with options in order to use the Extra payments feature but before doing so I wanted to make sure that this calculator would give the same results as the Fixed Principal Payment Calculator which was not the case. Equity after 10 years. NPS National Pension Scheme.

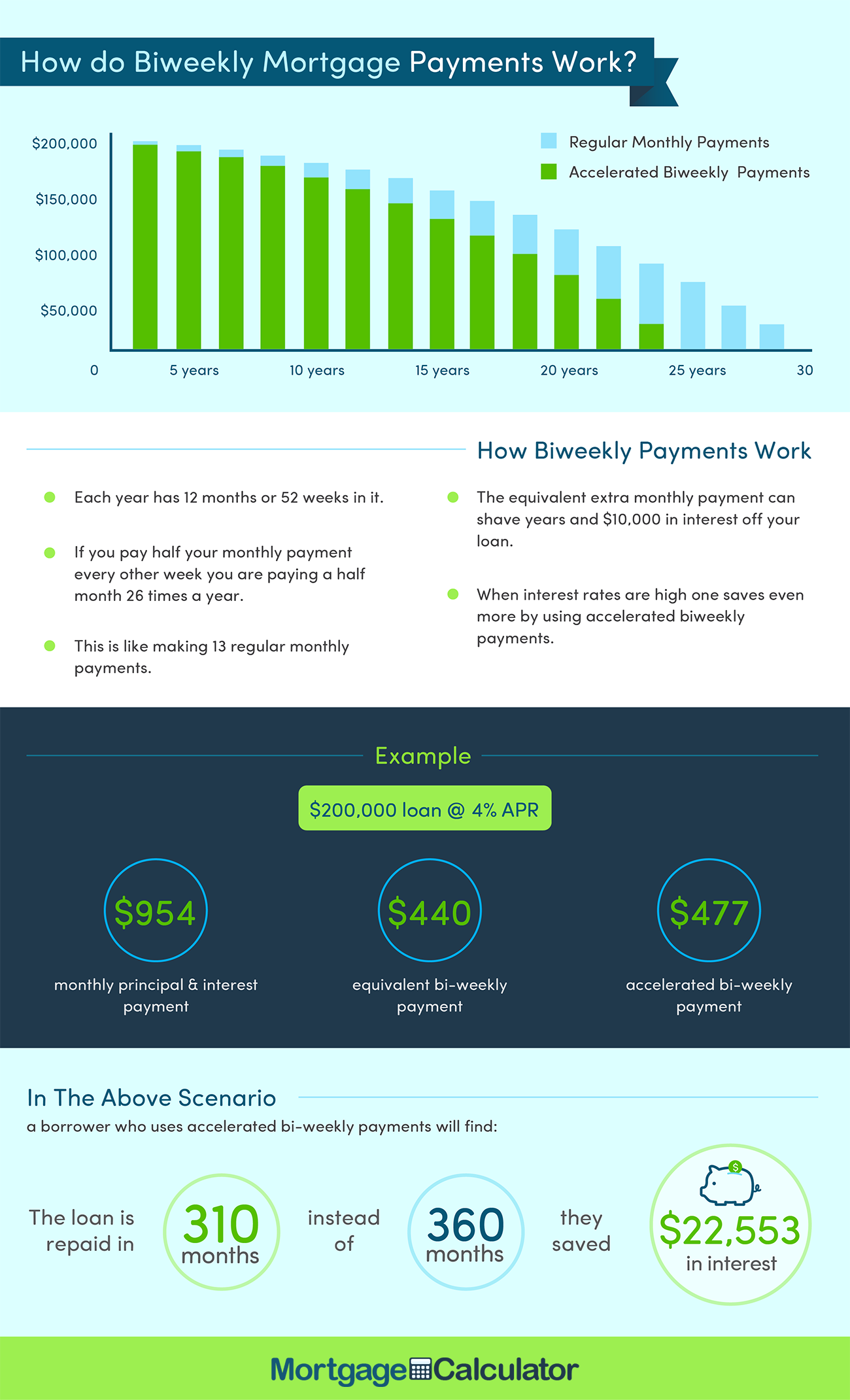

The required Monthly Payment plus any Additional Principal you want to pay each month. Todays average rate on a 30-year fixed mortgage is 599 compared to the 596 average rate a week earlier. This is comparable to 13 monthly payments a year which can result in faster payoff and lower overall interest costs.

Loan Original Payment. How we make money. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

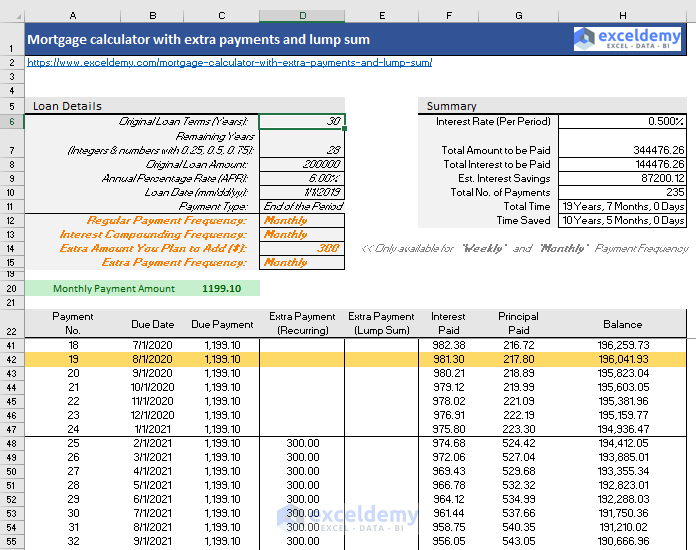

For example if you pay 1200 once per month as your entire monthly mortgage payment youre currently making monthly mortgage payments of 14400 per year. The mortgage calculator with extra payments gives borrowers four ways to include extra payments for their payments in case they want to pay off their mortgage earlier. If youre still confused whether this payment option is best for you use the biweekly mortgage calculator above to help you see the total savings that you could be getting.

Includes taxes insurance PMI and printable amortization schedule for handy reference. With bi-weekly payments you pay half of the monthly mortgage payment every 2 weeks rather than the full balance once a month. If you are paid biweekly then having a biweekly mortgage payment can make it easier to budget.

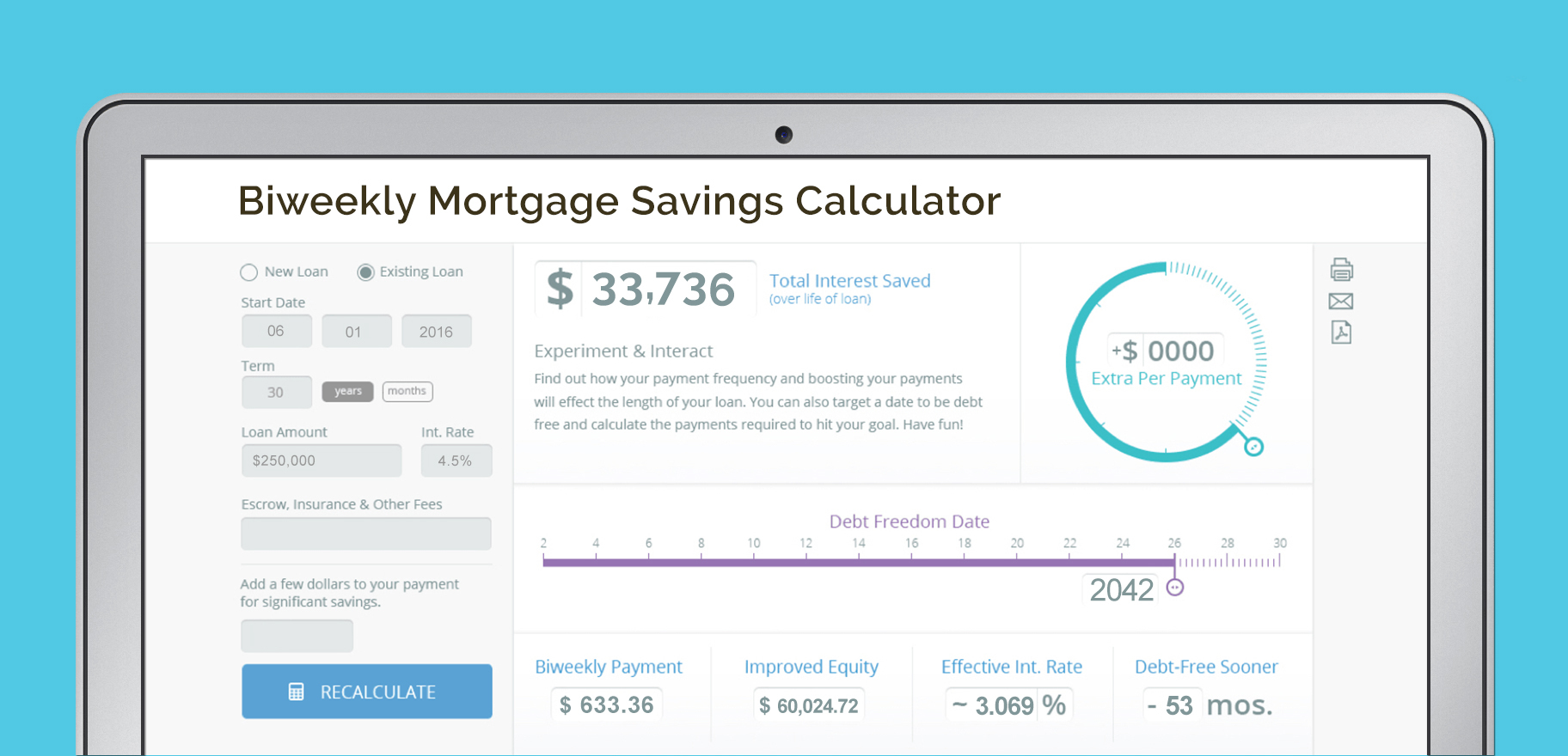

Current 30-Year Mortgage Rates. You can also use the calculator on top to estimate extra payments you make once a year. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

Choose the Best Strategy for Extra Payments. For those that have a higher interest rate than the example listed the savings are even more. This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

Many other variables can influence your monthly mortgage payment including the length of your loan your local property tax rate and whether you have to pay private mortgage insurance. Calculation assumes a fixed mortgage rate. When you change to biweekly payments youll make payments every two weeks.

Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per year. Starting from the first year of your loan. Increase your payment every two weeks slightly more and save even more.

Interest can add tens of thousands of dollars to the total cost you repay and in the early years of your loan the majority of your payment will be interest. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying. Take the time to use a mortgage calculator to see just how much money you can save by investing one extra payment per year into your home.

Actual mortgage rates may fluctuate and are subject to change at any time without notice. Equity after 5 years. By making an extra payment each year youll gain equity more quickly.

How much will my monthly mortgage payment be. Mortgage calculator with extra payments. Our calculator includes amoritization tables bi-weekly savings.

The Early Payoff calculations assume you will. Todays national 15-year refinance rate trends. Loan amount RMB 1080000 Number of payments 216.

The maximum amortization for a default insured mortgage is 25 years. Once you understand the fees associated with extra payments and the way that your payments are applied to the principal you can come up with the best strategy to pay off your loan more quickly. While each payment is equal to half the monthly amount you end up paying an extra month per year with this method.

Mortgage calculator with taxes and insurance. Bankrate is compensated in exchange for featured placement of sponsored products and. These include making lump sum payments or shifting to a biweekly payment schedule while making additional payments.

According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. Mortgage Payment Calculator With Amortization Schedule. The additional amount you will pay each month over the required Monthly Payment amount to pay down the principal on your loan.

30-Year Fixed Mortgage Principal Loan Amount. The more youve paid toward your mortgage the more equity in your house you own. Is approaching 400000 and interest rates are hovering around 3.

How much extra payment should I make each month to pay off my mortgage by a specific date and how much interest will I save. Another true bi-weekly payment calculator. Bi-Weekly plus Extra Mortgage payment.

Its Easier to Budget. You may need to pay just one large monthly payment on the loan in order to avoid fees and to pay it off as quickly as. The extra payment options are a one-time extra payment recurring biweekly monthly quarterly and.

You can increase your payment amount up to 100 of the original regular payment at any time over the mortgage term. If you raise your monthly payment by 170 from 830 to 1000 you could save almost 48000 in interest over the amortization period Opens a popup. Prints yearly amortization tables.

Please do not rely on this calculator results when making financial decisions. Please visit your branch or speak to a mortgage specialist.

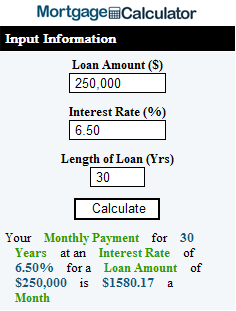

Mortgage Calculator Script Free Mortgage Calculator Widget

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Downloadable Free Mortgage Calculator Tool

Mortgage With Extra Payments Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Autopayplus Redefines The Crowded Online Mortgage Calculator Space Business Wire

The 6 Best Mortgage Calculator Plugins For Wordpress Interserver Tips

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator How Much Will You Save

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

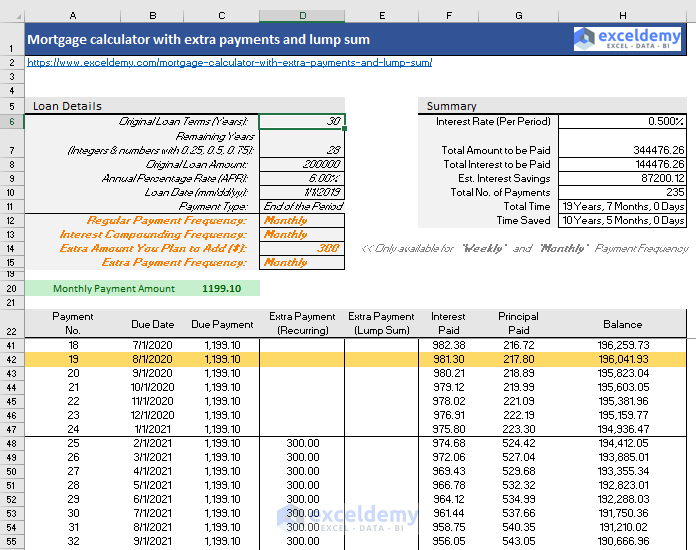

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator How Much Will You Save

The 6 Best Mortgage Calculator Plugins For Wordpress Interserver Tips

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template